In the rapidly evolving world of cryptocurrency, coming to grips with the multitude of associated terms and concepts is imperative. This article, “Can You Short Crypto,” aims to enlighten you on a wealth of topics within the realm of crypto; from understanding how to short cryptocurrencies, navigating where to purchase up-and-coming cryptos like Luna and Tiger King Coin, to mastering techniques of buying new cryptos before they’re officially listed. It will also guide you on how to sell cryptos on renowned platforms like Crypto.com and Robinhood, educate you on crypto terms like APY, spot trading, and crypto whales, and address critical issues like the eligibility age to invest in cryptocurrencies. Also on deck will be an in-depth look at many intriguing aspects of the crypto universe, such as crypto-friendly banks, the growing trend of crypto billionaires, controversies around cryptocurrencies on Reddit, and much more.

Understanding Short Selling

What is Short Selling?

Short selling or ‘shorting’ emerges as an investment strategy that relies on the market’s downfall to profit. It’s a practice where traders sell assets they do not own with the hope of buying them back at a lower price to make a profit—the difference between the sell price and the lower buy price becoming their profit. This mindset is contrary to the traditional ‘buy low, sell high’ approach most investors are familiar with.

Short Selling in Traditional Markets vs. Crypto Markets

Traditional markets like stocks and commodities have long accepted short selling. The regulated nature of traditional markets and the availability of instruments like futures and options make shorting a common practice. On the other hand, short selling in crypto markets is a more recent development. The volatile nature of cryptocurrency prices and the inherent risks associated with digital assets make short selling in the crypto market a risky venture, albeit a profitable one for savvy traders.

Risks Associated with Short Selling

Short selling, while profitable when accurately predicted, carries considerable risks. If your predictions do not come true and the asset price rises, you stand to lose significant amounts, sometimes even more than your initial investment. Theoretically, there’s no limit on how much you can lose because there’s no ceiling on how high the price of an asset can rise.

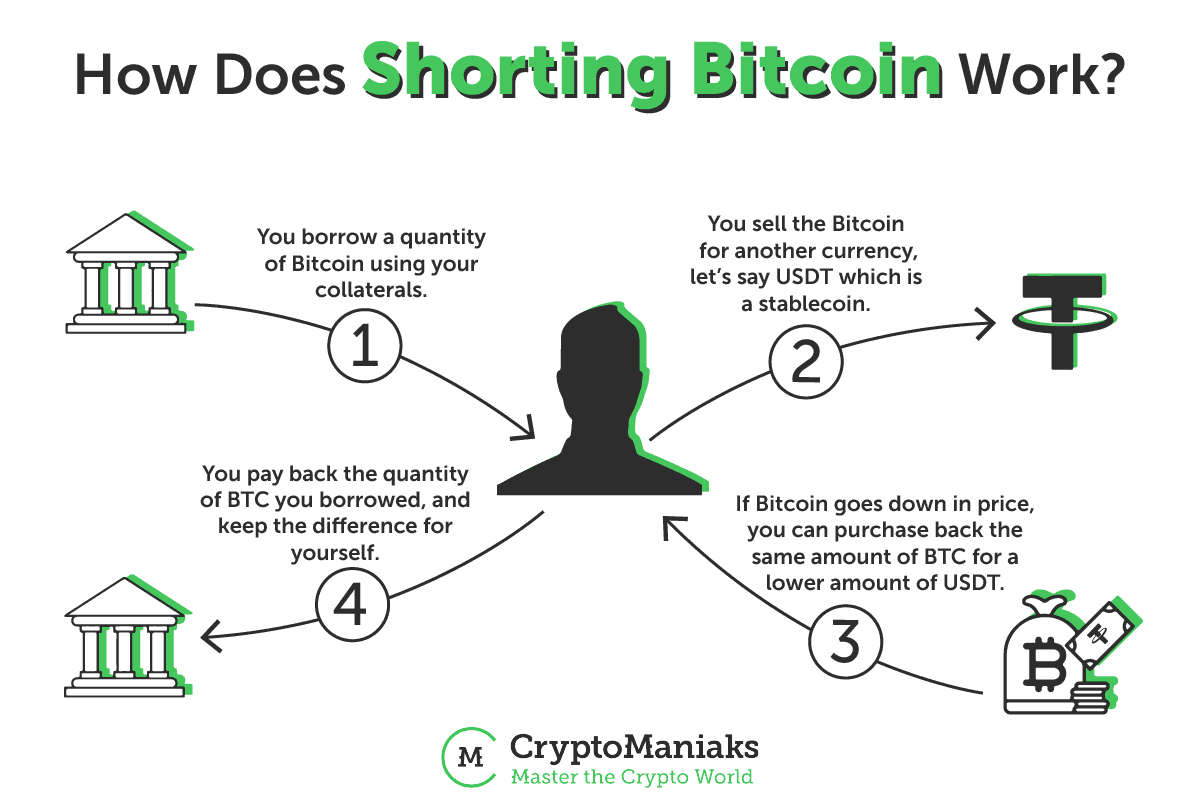

Mechanics of Shorting Cryptocurrency

How to Short Crypto: A Step-by-Step Guide

Shorting crypto generally involves borrowing cryptocurrency, selling it at the current market price, and then buying it back after the price has dropped. You then return the borrowed coins, making a profit from the price difference.

Margin Trading and Leverage

Margin trading allows traders to borrow funds to invest more significant amounts, effectively leveraging their positions. This can amplify profits but also magnifies losses if the market moves against the trader.

Using Derivatives to Short Crypto

Derivatives such as futures and options contracts are popular instruments used to short cryptocurrency. These contracts allow traders to agree on a future price for the asset, providing opportunities to profit even during market downturns.

Short Selling through Crypto Exchanges

Several cryptocurrency exchanges offer features that facilitate short selling. These include spot exchanges, margin platforms, and futures exchanges.

Shorting on Different Platforms

How to Short Crypto on Coinbase

Coinbase doesn’t officially support short-selling on its platform. However, you may do so by using the Coinbase Pro exchange. Here, you can use margin trading to short cryptocurrencies.

Shorting Crypto on Binance

Binance, a popular cryptocurrency exchange, supports futures trading which allows you to go short on cryptocurrencies. You just have to deposit the required collateral and enter the short position.

Short Selling on Kraken

Kraken provides a straightforward method for shorting crypto. With its margin trading feature, you can borrow crypto to short it.

Decentralized Options for Shorting Crypto

Certain decentralized finance (DeFi) protocols allow for short selling of crypto assets. This includes lending platforms where users can borrow assets to sell.

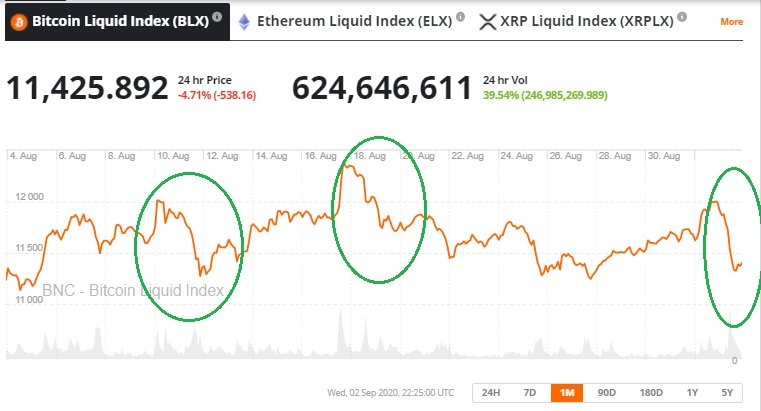

Analyzing the Market

Indicators and Strategies for Shorting

Effective shorting requires continued market analysis and understanding of technical indicators like moving averages, relative strength index (RSI), and so on. Sound strategies may involve understanding market trends, support, and resistance levels, and trading volume patterns.

Understanding Market Sentiments

Market sentiment plays a crucial role in short selling. Sentiment analysis helps understand potential market movements based on traders’ emotions and attitudes.

The Role of Technical Analysis in Shorting Crypto

Technical analysis involves studying price patterns and market data to predict future price movements. It is an invaluable tool for short sellers to make informed trading decisions.

Potential Pitfalls of Shorting Crypto

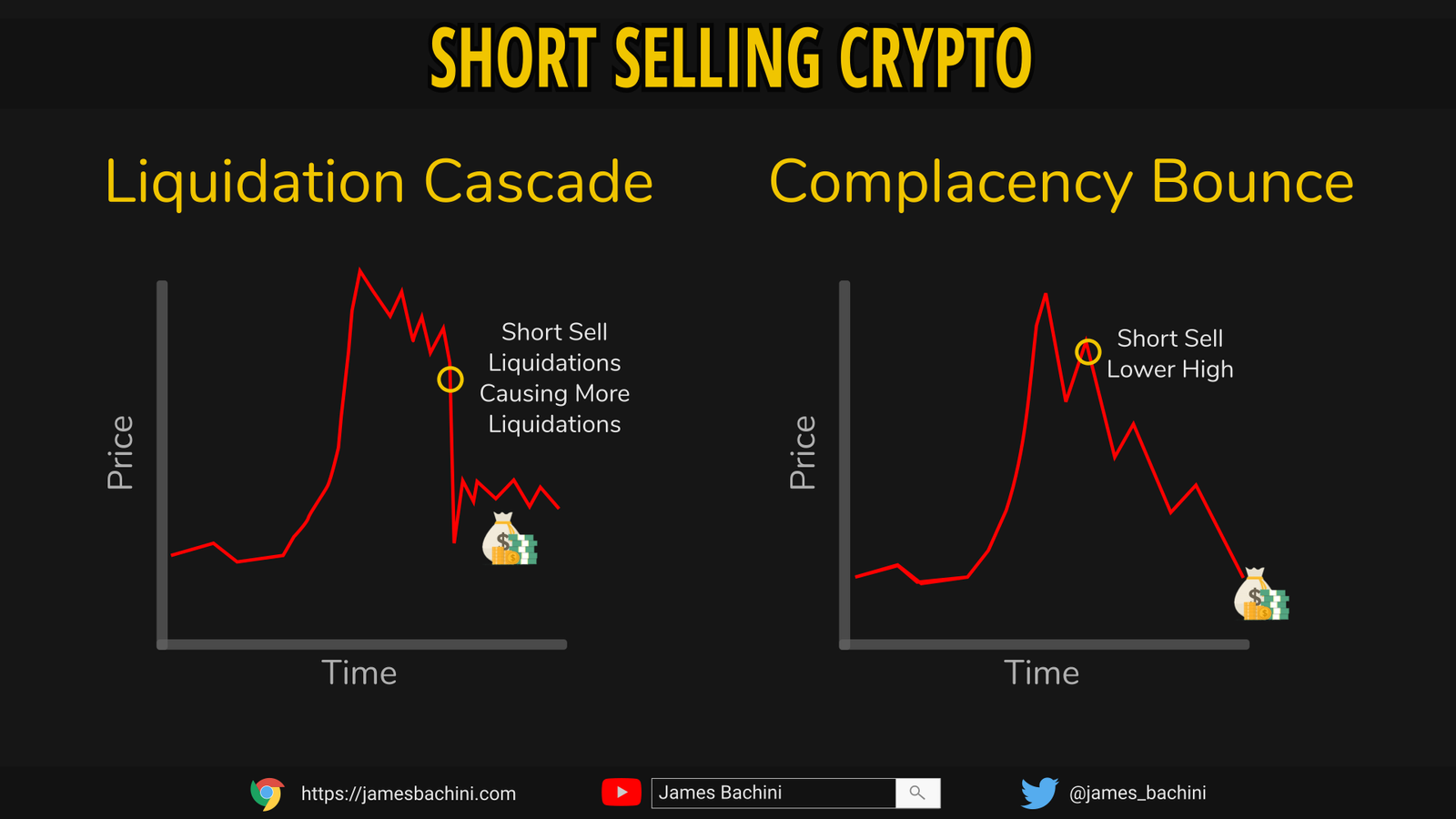

Volatility and Liquidation Risk

The volatile nature of cryptocurrency prices makes shorting a risky venture. Dramatic price increases (“short squeezes”) can lead to forced liquidations of short positions.

Regulatory Concerns

Regulation around cryptocurrencies varies widely and is continually evolving, leading to unpredictable market implications that can affect your short positions.

Counterparty Risks

When shorting cryptos, there’s a risk that the counterparty (the entity you’re borrowing from) won’t fulfill their obligations.

Consideration of Market Manipulation

Shorting can suffer significantly from market manipulation. Whales or large investors can artificially inflate prices, resulting in hefty losses for short sellers.

Benefits of Shorting Crypto

Portfolio Diversification

Short selling offers another method to profit from market movements, thereby providing a way to diversify one’s portfolio.

Profit Potential in Bear Markets

During market downturns, short selling is one of the few strategies that can still generate profits.

Hedging Against Market Downturns

Short selling can also serve as a hedge against potential losses in a downward trending or volatile market.

Legal and Ethical Considerations

Shorting and Market Regulations

Depending on the jurisdiction, shorting cryptocurrencies might have specific legal implications. Always make sure that your trading activities comply with local laws and regulations.

The Morality of Short Selling in the Crypto Space

Short selling often gets a bad rap as it profits from others’ losses. However, it’s a legitimate strategy, especially in volatile markets like cryptocurrency.

Avoiding Market Manipulation Practices

Engaging in or falling victim to market manipulation is a significant risk when shorting. Learn to identify signs of manipulation and avoid contributing to these practices.

Education and Resources

Crypto Trading Courses and Educational Material

There are countless resources online to help you understand shorting better. From online courses to eBooks to YouTube tutorials – there’s a wealth of knowledge available at your fingertips.

Communities and Forums for Short Sellers

Online communities and forums can be great places to learn from experienced traders. Platforms like Reddit, Discord, and Telegram host numerous crypto trading groups.

Online Tools and Analytics for Shorting Strategies

Several online tools and platforms provide real-time market analytics and other resources that are crucial for successful short selling.

Real-world Examples and Case Studies

Notable Short Trades in Crypto History

A handful of short trades have grabbed the crypto world’s attention due to their scale and timing, like those during the Bitcoin crash in 2018.

Lessons Learned from Successful Short Sellers

Successful short sellers tend to have common traits: rigorous market analysis, patience, clear trading strategies, and an understanding of market sentiments.

Famous Failures and the Lessons They Provide

Failure is a great teacher. Studying unsuccessful short trades can help you avoid similar pitfalls and better prepare for future trades.

Additional Topics and FAQs

How Old Do You Have to Be to Short Sell Crypto?

The legal age for shorting crypto varies from country to country, but generally, you must be 18 or older.

Can You Short Crypto Under 18?

Legally, you cannot. However, some under-aged traders find ways around this, like trading through a parent’s account. This is not recommended or ethical.

What Is APY in Crypto and How Does It Affect Shorting?

APY, or annualized payment yield, is a standard measure for interest rates in the crypto lending market. Higher APY might make borrowing crypto for shorting more expensive.

Crypto Short Selling Myths Debunked

There are many myths around short selling – that it’s only for professionals, it’s unethical, and so on. Most of these are based on misunderstandings around the strategy and its risks and rewards.