In the evolving realm of cryptocurrencies, you may have plenty of questions. How do you short crypto? Where to buy Luna or Tiger King Crypto? What exactly are Crypto Apex and Polygon Matic Staking? Seeking answers requires crossing the threshold into the fascinating, complex, and sometimes, perplexing world of crypto. This comprehensive guide aims to clear up the fog and arm you with knowledge, whether you’re curious about getting into crypto under 18, want to find out the APY in crypto or even join a crypto pump. From understanding the basics of how cryptocurrency works, to the intricacies of spot trading, and exploring pressing queries about crypto-friendly banks or characterizing a crypto broker, we’ve got you covered.

Understanding Short Selling in Cryptocurrency

Indeed, the new world dominated by crypto and its unique functions has thrust us into the rapids of financial revolution. Along the journey, it’s crucial to grasp terms like ‘short selling’ and other trading techniques to safely navigate the fluctuating waves of this digital financial ocean.

Definition of short selling

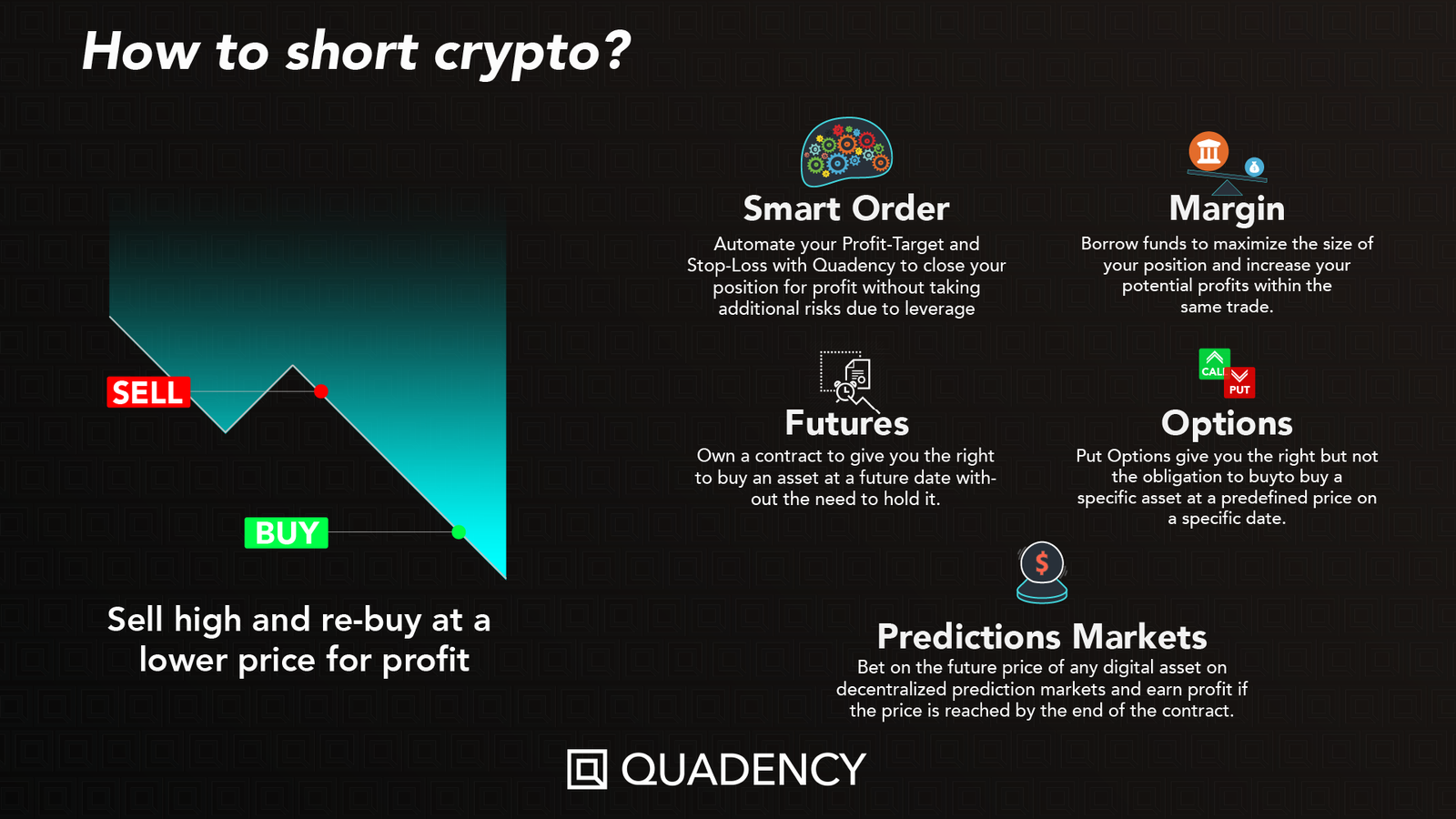

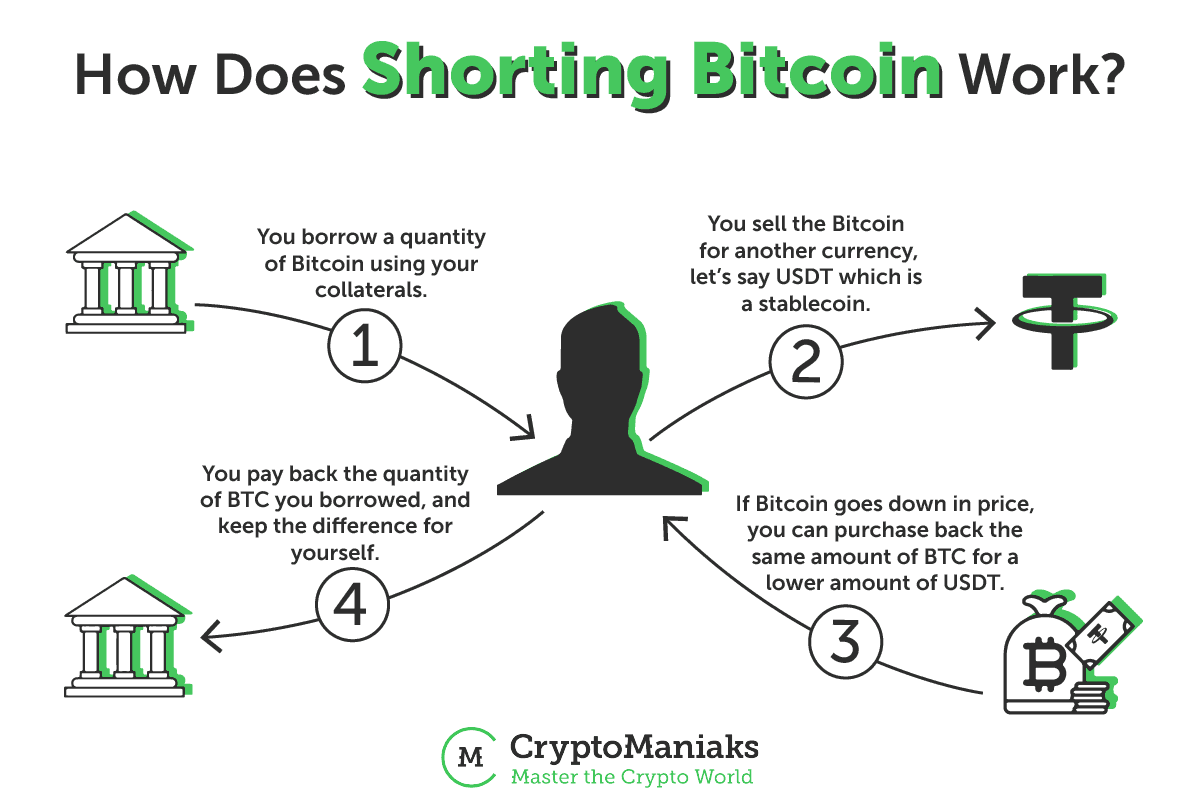

In the realm of cryptocurrency, short selling, often referred to as ‘shorting’ is a trading strategy where you essentially bet against a particular digital asset. Shorting means you borrow a cryptocurrency from a broker, sell it at the current market price, and then later buy it back, ideally at a lower price. You return the borrowed coins to the broker and pocket the difference in price, should any exist.

Mechanics of a crypto short sale

The mechanics of a short selling are not too complex, provided you have a clear grasp of the basics. First, you borrow a cryptocurrency from a broker and sell them immediately at the current market price, much like selling your own asset. However, in this case, you expect the price to fall in the near future, after which you can buy the same amount of cryptocurrency back but at a lesser price, and then return the borrowed sum to your broker. Your profit stands to be the difference in the selling and buying price, whereas if the price rises instead of falling, you experience a loss.

Risks involved in shorting cryptocurrencies

Shorting is not for the faint-hearted. The volatility of the cryptocurrency market considerably amplifies the level of risk involved in short selling. The potential for infinite losses is one of the major risks of shorting. As there is no upper limit on how high the price of an asset can surge, theoretically speaking, the losses can be infinite if the market trends against you.

Platforms for Shorting Crypto

Centralized crypto exchanges offering short selling

Apart from crypto wallets and peer-to-peer trading platforms, centralized crypto exchanges are popular venues for short selling. Some of the most well-known include Binance, Kraken, and Bitfinex. Each of these platforms allows traders to short cryptocurrencies by borrowing the digital assets to sell at a high and repurchasing them when the price hits lower.

Decentralized finance (DeFi) platforms and short trades

The decentralized finance (DeFi) realm opens up more opportunities for short trades. Platforms like dYdX, Compound, and MakerDAO allow traders to earn profits from price drops. These DeFi platforms let users supply cryptocurrency as collateral to borrow another type of cryptocurrency for shorting.

Comparison of fees and features on different platforms

Comparing fees and features is a crucial step before selecting a platform for shorting crypto. Fees vary across platforms – while some have relatively low charges, others may have substantial costs that can erode profits. Additionally, features like leverage, minimum deposit, and the cryptos available for shorting should also factor into your decision.

Short Selling Bitcoin and Other Major Cryptocurrencies

How to short Bitcoin

To short Bitcoin, one typically needs to borrow it from a broker, sell it at the current market price, wait for price to drop, buy it back, and then return the borrowed amount. Depending on the platform, different mechanisms and tools including CFDs, futures contracts, or options can be utilized for shorting Bitcoin.

Ethereum and other altcoins: Shorting strategies

A similar approach can be used for Ethereum and other altcoins. In addition to spot and margin trading, futures and options can be exploited to short altcoins. As strategies vary with market conditions, constant monitoring, analysis, and adjustment of your shorting strategy are necessary.

Impact of market capitalization on shorting crypto assets

The market capitalization of a cryptocurrency significantly impacts the feasibility and success of a short sale. Cryptocurrencies with larger market caps like Bitcoin or Ethereum are more liquid, making them easier to short sell. In contrast, low cap ‘altcoins’ might be more risky to short due to their high volatility and lower liquidity.

Shorting Crypto Derivatives and Futures

Understanding crypto derivatives

Crypto derivatives are financial contracts that get their value from the performance of the underlying cryptocurrencies. They include futures, options, or swaps and can be utilized for hedging, speculating, or gaining access to otherwise hard-to-reach markets.

Leveraging futures contracts to short crypto

A futures contract is an agreement to buy or sell a cryptocurrency at a predetermined price at a specified future date. By leveraging futures contracts, one can effectively short a cryptocurrency without having to own it. You just need a margin account, and from there, you can enter into a contract to sell the asset at a future date, hoping the price falls by then.

Margin requirements and liquidification in futures trading

Margin requirements refer to the collateral you need to open and maintain a position. It’s important to be aware of these as falling below the required margin level can lead to liquidation of your position by the exchange to cover losses. Every platform has its own margin requirements, making understanding these prerequisites crucial before entering into any contract.

Analyzing Market Sentiment and Indicators

Technical analysis for short selling

Technical analysis is a tool to predict future price movements based on past market data. It involves the use of charts and indicators to identify trends and patterns that can suggest future activity. For short selling, bearish patterns and indicators can be valuable.

Sentiment analysis and its impact on short trading

Sentiment analysis or the process of gauging market opinions can impact short trading significantly. Negative news or pessimistic sentiment can trigger a price drop, creating ideal conditions for short selling. Conversely, upbeat sentiment and positive news can boost prices.

Use of indicators and trade signals for shorting crypto

Certain trade signals and indicators can be useful for short selling. For example, a moving average crossover, where a short-term average crosses below a long-term average, may indicate a downward trend. The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are other popular indicators that traders use to detect potential short selling opportunities.

Shorting Crypto Via Margin Trading

How margin trading works in crypto

Margin trading allows traders to borrow funds to trade more crypto than they could with their existing funds. In other words, it amplifies your trading power by providing you more ammunition to bet with, thus potentially increasing your profits. However, this also increases the risk as losses can be equally magnified.

Interest rates and borrowing costs on margin trades

Margin trading involves borrowing cryptocurrency, which comes with interest rates and borrowing costs. These vary from platform to platform. Understanding how these interest rates apply is vital as they may eat into your profits or add to your losses.

Best practices for managing risk in margin trading

Managing risk in margin trading is essential. Setting stop losses, keeping track of margin levels, not over-leveraging, and not risking more than you can afford to lose are some of the best practices. You should also keep a close eye on market trends and news that might impact your positions.

Regulatory Considerations in Short Selling Crypto

Global regulations on shorting digital assets

The regulations for shorting digital assets are not uniform globally, with some countries putting restrictions while others offer a more free reign. It is critical to understand the legal framework in your region before you start to short sell cryptocurrencies.

Tax implications of short selling cryptocurrency

Short selling crypto can also have tax implications. Depending on country-specific laws, the profit from shorting might be taxable income. It’s prudent to consult with a tax professional to understand the potential impacts.

Legal risks associated with crypto short selling

Short selling itself is a legal activity. However, practices like naked short selling, where you sell without borrowing the assets first, are illegal in many jurisdictions. Therefore, it’s crucial to understand the rules to avoid any legal issues.

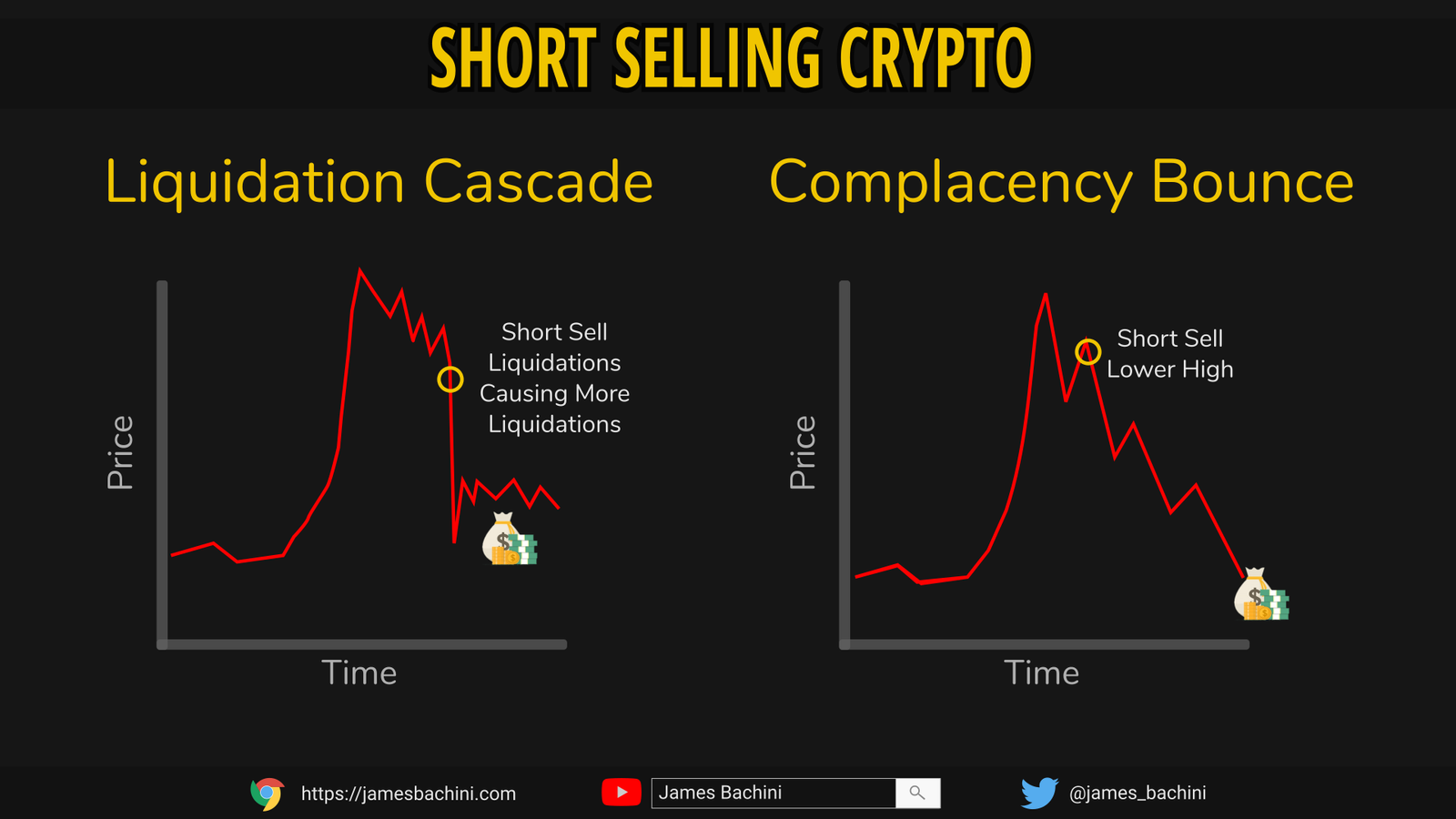

Short Squeeze in Cryptocurrency Markets

What is a short squeeze?

A short squeeze happens when a heavily shorted asset sees a sharp rise in its price, which forces short sellers to close their positions (i.e., they need to buy the asset to do so). This surge in buying activity can further propel the price, causing more short sellers to close their positions – creating a vicious cycle or a ‘squeeze.’

Historical examples of crypto short squeezes

Historically, short squeezes aren’t uncommon in the crypto markets. One notable example is Bitcoin’s short squeeze in July 2018, where a rapid 10% increase in Bitcoin’s value came with around $180 million worth of short positions being liquidated on BitMEX, a popular cryptocurrency trading platform.

How to avoid being caught in a short squeeze

Being vigilant, using stop losses, not over-leveraging oneself, and maintaining margin levels can help traders avoid being caught in a short squeeze. Regular monitoring of the market and keeping abreast of news that could impact the price also helps.

Hedging Strategies Using Short Positions

Basics of hedging with short positions

Hedging is a strategy to reduce the risk of adverse price movements in an asset. In terms of crypto, one might use short positions to hedge against potential losses on a long position. This strategy involves opening a short position for a crypto asset that you own.

Combining long and short positions for portfolio protection

One common hedging strategy involves maintaining both long and short positions in the same or different assets. This kind of balanced portfolio can help offset potential losses from one side by gain on the other.

Examples of successful hedging strategies in crypto

While there’s no perfect hedging strategy, some have proven quite successful. A popular one is to maintain a diversified portfolio across different crypto assets. While holding a long position on Bitcoin, for example, a trader could open short positions on altcoins that tend to move in the opposite direction.

Educational Resources and Community Support

Forums and online communities focused on short trading

A variety of forums and online communities focus on short trading. Subreddits like r/CryptoCurrency and r/BitcoinMarkets occasionally have enlightening discussions on short selling. There are also trading groups on Telegram and Discord where traders share insights and strategies.

Courses and webinars on advanced trading techniques

Certain online platforms offer courses and webinars on advanced crypto trading, including short selling. These educational resources, designed for varying levels of expertise, can hugely benefit those looking to delve into the world of shorting.

Case studies and expert analysis on short selling scenarios

Case studies and expert analyses can provide insights into real-world short selling scenarios, offering a valuable learning experience. These can be found in financial blogs, crypto trading news platforms, and sometimes, within the educational section of trading platforms. They offer not only specifics about specific instances of short selling but also share insights about the thought process and analysis behind each move.

Navigating the intricate world of cryptocurrency and trading techniques like short selling can indeed feel overwhelming. However, armed with adequate knowledge, right tools and a cautious approach to manage risks, you can potentially turn this complex maze into an opportunity-laden marketplace.